How Stablecoins Are Powering Faster Cross-Border Payments in Neo Banking

We cannot deny the fact that the global financial ecosystem is going through constant transformation. From slow transaction speeds and lack of mobile convenience to neobanks and stablecoins, we have already come a long way. But since there is a massive demand for cross-border transactions, these concepts are in high search volumes, and if you are also looking to understand the same or planning Blockchain Financial Services development, then this is the article for you.

Traditional banking challenges faced by economies

There came the banking revolution in the whole world, where a user visits the nearest banking branch and gets all the banking benefits. And this system was enforced for more than 200 years, and if we look at the modern market, which keeps on changing in terms of technology, the legacy systems of banks are operating on outdated models. These models are so outdated that they are difficult to upgrade for technologies like blockchain, and even if somebody plans to do it, the cost remains expensive.

Not only this but the banks were slow in transactions and banks that are running on a modern fintech foundation are saving up to 50% more in costs as compared to slow traditional banking processes. After that, no mobile experience for banks was easily leading to dissatisfaction from the customers who prefer convenience over anything else.

If any bank plans to upgrade their legacy systems, other than being costly, the upgrades like cloud computing, AI, data analytics, and user personalization are complex until a bank finds out the right blockchain development services provider.

Why is driving fast a cross-border payment?

For nearly every bank, due to the traditional banking challenges, delivering next-level payment experiences has become an important aim. They especially wanted to deliver the best cross-border payment services because the cross-border payments themselves reached $194.6 trillion in 2024 and now in the coming 8 to 10 years, you can expect them to cross $300 trillion.

People need fast banking payment systems to send cross-border money, which can increase the satisfaction among customers. Then the key thing that is driving the best cross-platform payment systems is the fintech disruption among the financial institutions. Also, platforms like Apple Pay and other investment platforms do want to integrate faster service providers or the ones running on blockchain technology on their platforms.

What actually are Stablecoins, and how do they make a difference?

If you study the cryptocurrency market, you can easily identify that Bitcoin has never been stable, as its price keeps on fluctuating. But stablecoins solve this, as they are stable by pegging values to fiat currencies, thus lowering the volatile risks for the market as well as all the users.

Mainly, you are seeing the 4 types of stablecoins starting with fiat-collateralized, which are fiat-based stablecoins having reserves of currencies in US dollars. With that, we have commodity-backed stablecoins that are backed by commodities like gold and oil. The third type, which is crypto-collateralized stablecoins, are backed by currencies held in the reserves, and the fourth type are the algorithmic stablecoins that ensure stability with computer algorithms.

Among the stablecoins, Tether is a very popular one, as it is backed 1:1 with US dollars, giving the best exchange services to cryptocurrency users for banking transactions. So, of course, traders using cryptocurrencies for everyday transactions do not have to pay with thousands of bitcoins for pizzas due to the lower market rates, as they can have the option of stablecoins.

What are Neobanks?

One concept that is popular among the users dealing in stablecoins or cryptocurrencies is NeoBanks, as these users prefer NeoBanks to make transactions with. Although traditional financial institutions dominated for a long period of time in the market, they are not very accessible to the consumers who live far away from the bank branch locations.

Now, NeoBanks have sold this with modern Fintech and a good example of the same is Chime, which falls among the top 10 US banks, having 13 million customers in 2021 and now they have 21 million users. Plus the neobanks have easy-to-use APIs for integrating banking systems with all the modern third-party platforms, supporting a range of functionalities like deep insights, payments, payables and receivables, bank statements, and a lot more.

However, a smooth integration like stablecoin wallets would demand an experienced crypto exchange platform development for the best smoothness and overall quality.

How are stablecoins and neobanking important in cross-border payments?

By now you must know that stablecoins and neobanks are there for faster, cheaper, and more transparent transactions that traditional banking methods were lacking for the users. The cost of transactions is also low as compared to the international wire transfers, which had a range of mediator banks for fee addition, foreign exchanges, and a lot more. Not only this, but the stablecoins are faster with 24×7 settlement and why not? They do not operate on a limited schedule, as blockchain is always running, settling transactions in minutes and mostly in seconds, whereas traditional banks were taking 7 days to transfer amounts sometimes.

Also, the FX risks stay low as users hold value in a stable asset system, which protects them from the volatility of local currency inflation. Neobanks are becoming a go-to option for the underbanked as well as the unbanked populations, which are not able to access banking systems either due to living in rural areas or residing far away from the branch locations and with neobanks, all you users need is a smartphone and internet to access banking requirements.

These banks are built on Blockchain Financial Services, like smart contracts, which automate the payment system with conditional settings, automatic payrolls for international contractors, and also automate the supply chain payments.

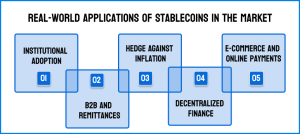

Real-world applications of stablecoins in the market

You must be wondering about the real-world applications of stablecoins in the market after knowing about all the benefits and popularity we talked about so let us discuss the same.

You must be wondering about the real-world applications of stablecoins in the market after knowing about all the benefits and popularity we talked about so let us discuss the same.

- Institutional adoption: More educational institutes want to provide the most diverse options of payments, where stablecoins have been a key adoption so that none of their students face issues in paying the fees.

- B2B and Remittances: For businesses that want to settle invoices instantly,stablecoins come out as a better and cheaper option.

- E-commerce and online payments: With stablecoins, online merchants can accept payments from a global customer base and receive funds instantly, as it bypasses traditional banking systems, which cause delays and high transaction fees.

- Hedge Against Inflation: There are countries that experience high inflation or currency devaluation but stablecoins pegged to a more stable currency like the US dollar give a way for citizens to protect their savings. They can hold their money in a digital asset, which maintains its value, instead of local currency, which keeps on losing purchasing power.

- Decentralized Finance: Stablecoins are also foundational to the DeFi ecosystem, as they are used in various apps for lending and borrowing.

Building Your Own Stablecoin or Neobanking Platform

If the challenges of traditional banking have inspired you to create a modern solution, you might be considering creating your own stablecoin or your own neobanking platform. This is a complex idea, but for sure is rewarding when you go with a clear vision, a strong technical plan, and stick to the regulatory standards.

Developing a neobanking platform

Creating a neobank starts with

- Clear understanding of the audience that is going to use your solution, where you must be clear about the pain points you want to solve.

- Define the values of your business and focus on the niche market, like solving problems for freelancers or students or international residents to meet their needs.

- Have a smooth core banking system for transaction handling, accounts management, and third-party integrations with APIs.

- A few key features to ensure are a multi-currency wallet, biometric verification, spending analytics in real time and an automatic savings tool.

- Make sure to hire the right crypto exchange platform development company for the crypto dealings.

Creating a stablecoin exchange

A stablecoin exchange platform becomes a key component for a world where stablecoins are used for daily transactions. The development of such a platform goes through the following steps.

- Picking the right type of stablecoin to support (the types we talked about above)

- Using a high-performance matching engine to execute reads smoothly

- Multilayer encryption, cold storage for funds and strong fraud monitoring to deliver the best security

- Liquidity in the platform so users can buy and sell assets without price slips

- Compliance with local and international finance regulations to gain user trust

- Finding the right cryptocurrency wallet development services provider with good experience

How can NetSet Software help you with your blockchain vision?

Whether you plan to create a fintech banking system or your own cryptocurrency wallet, or private blockchain development, we are the industry leaders when it comes to developing blockchain solutions. Our team delivers end-to-end services so whether you want to go with consultation or the full product development cycle, we can help you bring your vision to life. So, why wait and not start developing your blockchain solution with a company having 2 decades of industry experience?

What is next in the future?

For sure we are going to see more cross-border payments due to the fact that neobanks and stablecoins are making it more convenient for the users. The stablecoin market will also mature, and you can expect to see more partnerships with the payment networks. Then the user experience will become better, going to get deeper integration with traditional banking rails like SEPA and ACH, and finally there will be more demand for blockchain development companies that can help financial institutions to achieve the potential of neobanking and stablecoin.

FAQs

What is the key difference that makes neobanks better than neobanks?

The main difference here is the physical presence, as traditional banks have a network of physical branches, while neobanks completely work in digital mode.

Are neobanks really safe just like the traditional banks?

All the neobanks partner with traditional banks but they are insured by the state governments so you get the same level of safety you get with the traditional banks.

Why is Bitcoin not the best choice for cross-border payments?

Bitcoin is a great option for payment, but it is a highly volatile asset, which means that its value fluctuates too often, making it a risky choice but stablecoins maintain a stable price by being pegged to fiat currency like the US dollar, best suited for everyday transactions.

How do stablecoins lower the cost of international transfers?

Stablecoins work on blockchain, which lets them bypass the traditional banking system so your transactions are direct and have lower fees.

Are stablecoins regulated like other popular cryptocurrencies?

While some countries and regions have clear frameworks, others are still developing, but in the near future, stablecoins are going to be the trending cryptocurrency in the market.